Business Expense Deductions 2024 Tax – Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security .

Business Expense Deductions 2024 Tax

Source : www.freshbooks.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

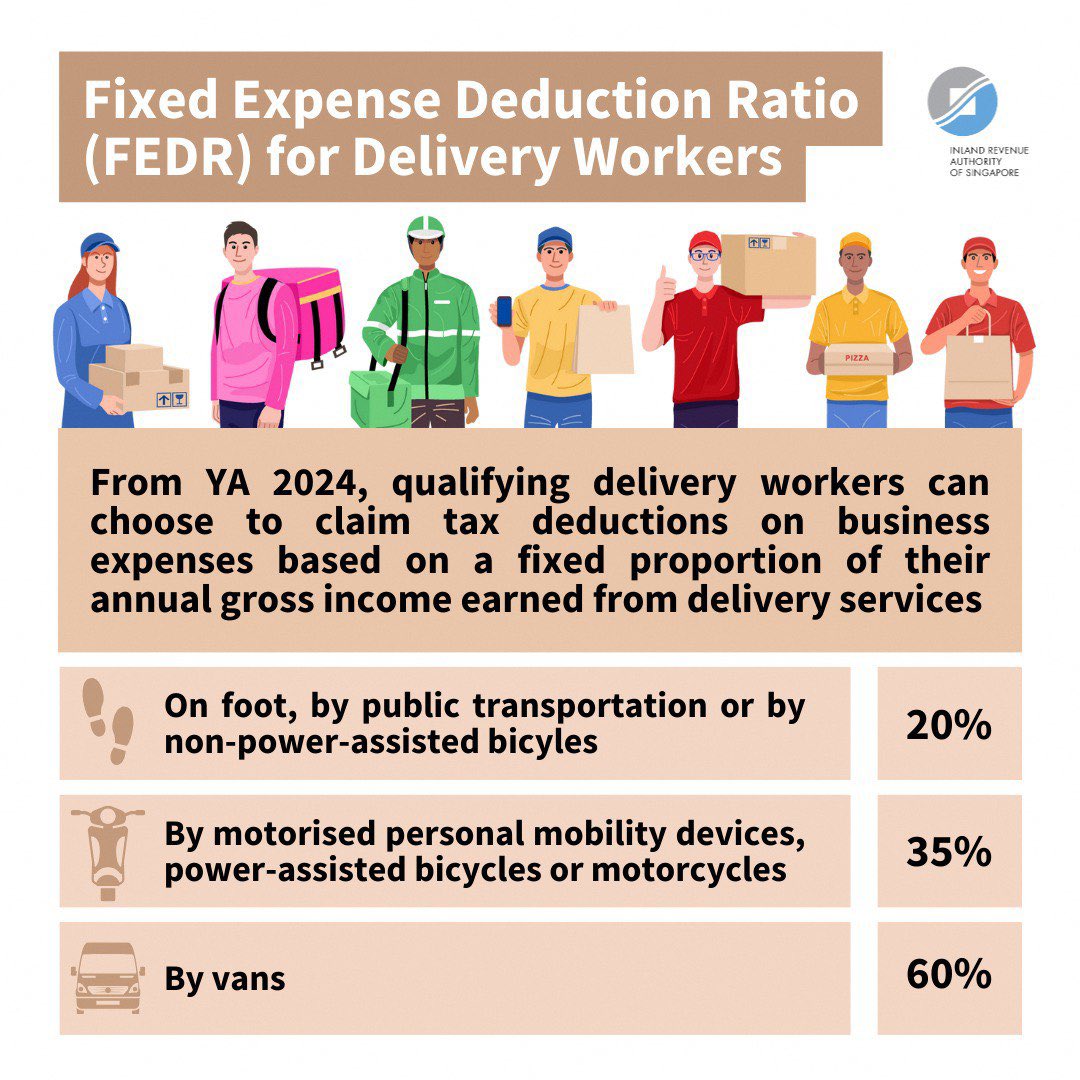

Source : quickbooks.intuit.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.com2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comSmall Business Tax Deductions Cheat Sheet, Tax Deductions Item

Source : www.etsy.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.comBusiness Expense Deductions 2024 Tax 25 Small Business Tax Deductions To Know in 2024: Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . The energy efficient home improvement credit can help homeowners cover up to 30% of costs related to qualifying improvements made from 2023 to 2032 .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)