Employee Business Expenses 2024 Tax Deduction – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . The Internal Revenue Service allows taxpayers to deduct income tax form. Employees can itemize their Internet access costs on the IRS form 2106 for employee business expenses. .

Employee Business Expenses 2024 Tax Deduction

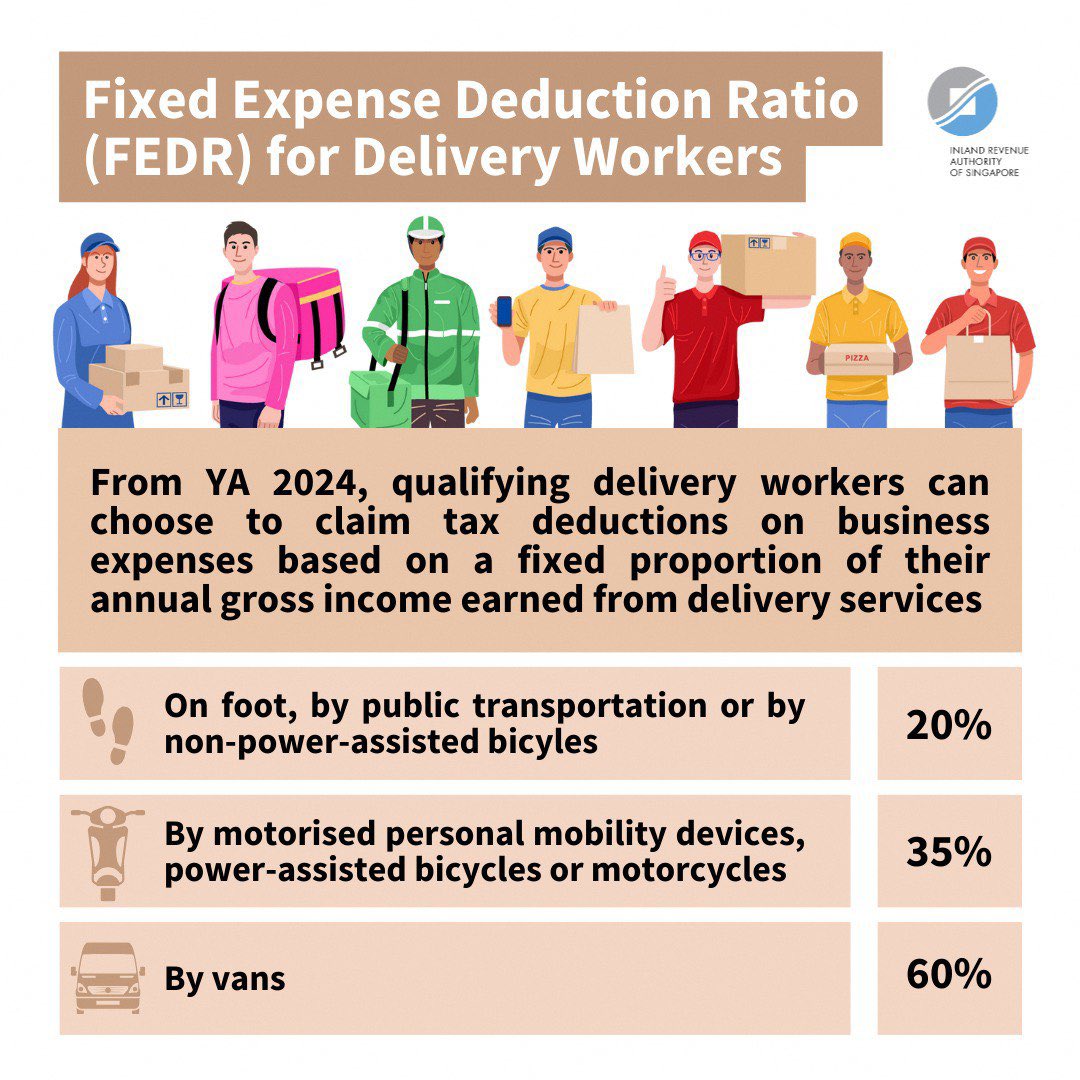

Source : www.freshbooks.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comForm 2106: Employee Business Expenses: Definition and Who Can File

Source : www.investopedia.comSelf Employment Tax Deductions and Benefits 2024 Absetax

Source : absetax.comMcDaniel & Associates, P.C. | Dothan AL

Source : www.facebook.com19 Tax Deductions for Independent Contractors in 2024

Source : www.deel.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comIRAS on Instagram: “Good news for delivery workers! 🙌 With effect

Source : www.instagram.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgDeducting Meals as a Business Expense

Source : www.thebalancemoney.comEmployee Business Expenses 2024 Tax Deduction 25 Small Business Tax Deductions To Know in 2024: On the financial side, deductible business expenses relating to the company must be claimed on the S corporation’s tax employee of an S corporation can also take the deduction for unreimbursed . The biggest deductions for work expenses are restricted to self-employed people and small business owners, but some full-time employees can get a few tax breaks too. If you’re one of the many .

]]>

:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)